Dollar-Cost Averaging at Work: A Systematic Approach to Investing

One of the easiest and most effective ways to jump-start your retirement savings is through dollar-cost averaging.

The principle behind dollar-cost averaging is simple: invest a fixed amount of money into an investment at regular intervals (e.g., every pay period). By systematically investing the same amount each period, you spread your purchases over time, and your average cost per share should be lower than if you had invested the money all at once.

Dollar-cost averaging also takes much of the emotion and guesswork out of investing in the market, potentially resulting in a better price than if you had guessed when to invest.

Features of Dollar-Cost Averaging

Dollar-cost averaging helps put several key principles of investing to work:

- It’s a long-term strategy that can help you invest on a regular basis over time.

- It helps you avoid trying to time the market—a common mistake that many investors make. When the market is rising, it’s tempting to jump in, and when the market is taking a tumble, many investors choose to sell instead of waiting it out.

- It keeps you on track toward meeting your long-term goals.

Although dollar-cost averaging won’t guarantee a profit or prevent a loss, it may help reduce investment risk—and it’s a simple and easy way to build your retirement savings.

Dollar-Cost Averaging at Work

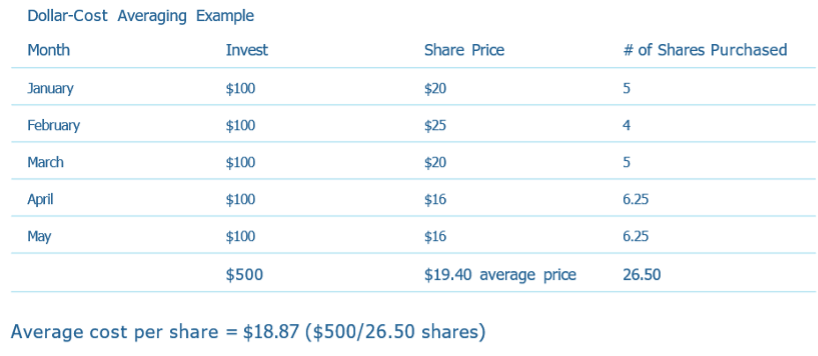

The chart below illustrates how putting $100 per month into the same investment may result in a better

average share price.

Dollar-Cost Averaging Example

This chart is hypothetical and for illustrative purposes only and is not intended to be a projection of future values of any product. The investment return and principal value of an investment will fluctuate, and an investor’s interest, when redeemed, may be worth more or less than the principal value. Actual results will vary. Past performance does not guarantee future results.

Dollar-cost averaging is not a foolproof investment technique. It does not assure a profit or protect against loss in declining markets. It involves continuous investment in variably priced units, regardless of price fluctuations. Investors contemplating the use of dollar-cost averaging should consider their ability to continue purchases over a period of time even when prices are low.